Habitational Insurance

2023 Habitational Insurance Market Overview

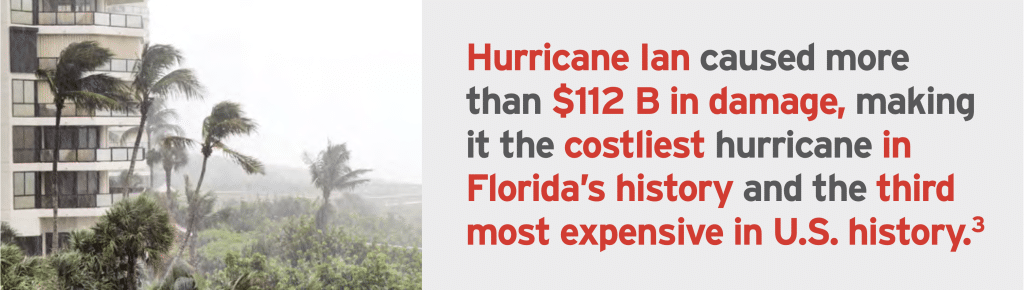

The 2023 habitational insurance market is facing significant challenges due to years of low rates, low property valuations, and the impact of catastrophic events. As insurers deal with frequent and severe claims, along with climate risks, navigating this marketplace requires creativity, solid risk assessment, and adaptability.

Key Trends in Habitational Insurance

Property Capacity and Underwriting Discipline

The habitational market, valued at $22 billion, is seeing reduced property capacity. Many carriers are exiting due to profitability concerns, leading to stricter underwriting guidelines. To remain competitive, brokers must adapt to these new challenges by adhering to minimum Insurance to Value (ITV) requirements of $125–$150 per square foot.

Non-Admitted E&S Market Emerges as a Solution

As traditional carriers retreat, non-admitted Excess & Surplus (E&S) markets have become a viable option for habitational coverage. These markets offer more flexibility and should no longer be considered a last resort. Collaborating with experienced wholesalers can help secure better coverage options from top-rated national carriers.

Challenges with Older Construction

Insurers are reducing their appetite for older properties, particularly those with frame and joisted masonry (JM) construction. Properties with outdated systems—such as old electrical panels and roofs—face limited options, and premiums for older buildings could increase by 100% or more.

Valuation Adequacy and ITV Adjustments

Carriers are placing more emphasis on ITV, with mandatory increases of 30%–40% in premiums due to stricter valuations. Property owners, especially in coastal areas, could face triple-digit premium hikes as limits are restructured to reflect these market changes.

Rising Deductibles

Deductibles are increasing across the market. Property owners may now face deductibles ranging from $50K to $250K, particularly in areas vulnerable to wind or hail. Some regions are also seeing percentage-based deductibles (e.g., 5%–7.5% in the Southeast).

Market Exit and Coverage Shifts

As large carriers exit the market, many insureds are turning to E&S for monoline coverage, leading to significant premium hikes. This shift is especially tough for those unaccustomed to the more complex E&S market and its higher premiums.

What Agents Can Do

To help clients navigate these challenges, agents should focus on providing thorough submissions, leveraging detailed property data (e.g., updates on roofing, plumbing, electrical systems), and considering deductible buy-down options. A comprehensive risk management strategy can also improve the chances of obtaining favorable terms.

Final Thoughts: Navigating the Hard Market

While market conditions may seem overwhelming, there are still opportunities for those who adapt. Carriers are monitoring claims and losses, which makes accurate risk assessment and proactive communication key. By working closely with a knowledgeable broker and leveraging the right data, businesses can secure the coverage they need in this challenging market.