Habitational Insurance

2023 Habitational State of the Market – Property

In 2023, the habitational insurance marketplace presents many challenges for property placements. Years of low rates and low valuations, combined with the impact of catastrophe events has created a perfect storm for the hard market. Property owners, insurers, and brokers find themselves grappling with a new reality where traditional underwriting models must contend with the weight of severe and frequent claims as well as the persistent specter of climate-related perils. Navigating this marketplace demands a deliberate balance between creativity, sound risk assessment, and adaptability to secure coverage.

PROPERTY OUTLOOK

Historically, habitational business has fallen victim to Insurance to Value (ITV) fluctuations, and underwriting discipline is working to correct the market. Property capacity is scarce. Carriers struggling with profitability in this segment are exiting the market, and underwriting guidelines are tighter across the board. However, the habitational property market – worth $22 billion – needs to be serviced, presenting opportunity for brokers and agents to thrive in the sector. 1

With the advent of sophisticated modeling tools, there is no hiding for habitational risks. Today, minimum ITVs of $125 – $150 per sq. ft. are needed on Statements of Value (SOVs). Refusing to adhere to this discipline will earn an agent silence or a declination from underwriters. As admitted carriers’ habitational appetites shrink, non- admitted excess and surplus (E&S) line markets have become an increasingly attractive coverage option – not only for challenging risks but also as an alternative for traditional accounts. In other words, non-admitted coverage is no longer a last resort. It’s a viable option offering greater flexibility compared to standard markets. Partnering with a trusted, knowledgeable wholesaler broker can be the key to finding a well-credentialed program with a top-rated national carrier that can meet an insured’s needs.5

CARRIERS AVOIDING FRAME & JOISTED MASONRY HABITATIONAL

There is reduced appetite nationwide for older frame and joisted masonry (JM) construction. Structures with older electrical panels, aluminum wiring, or older roofs will also have fewer market options. Previously, 15 – 20 carriers quoted this class/construction, generating robust competition. Only a handful of markets remain to dictate both terms and pricing. Insureds need to brace for what could be upwards of triple-digit increases from traditional standard market pricing on older real estate (pre-1990) due to the performance of older construction, which has limited the number of carriers willing to provide terms for older property.

Said differently, restricted capacity means that while it was previously possible to obtain $25M in capacity with a single carrier, it now takes five or six to achieve the same $25M in limits, with each carrier potentially requiring higher minimum premiums that elevate the total price. Also, if an insured’s expiring values were $25M, they may be closer to $35M – $40M at renewal due to inflationary concerns and a greater focus on ITV, which affects premium calculations and drives prices higher.

On very large frame habitational accounts, including sprinklered podiums and wraps, admitted and program markets are pushing to avoid a potential total fire loss by requiring superior fire protection, including confirmation of NFPA 13 as opposed to NFPA 13R sprinklers. This requires a transition to layered policies that are incredibly expensive due to carrier minimum premiums and maximum capacity guidelines as well as perceived fire risk.

How Agents Can Help: Make sure clients are doing everything possible to limit losses and ensure they understand the complexity and pricing difficulty defining the current habitational market. Leveraging proper analytics can make a difference when negotiating with lenders that require full limits. Providing available details on property updates or improved property management can also help set your insured apart in the underwriting process. Make sure to share key information about a property’s condition, foundation connection, roof anchors, roof age, and roof geometry. Documentation regarding plumbing, electrical and roofing updates can have a significant impact on modeling results. Partnering with a knowledgeable wholesale broker skilled in sharing the insured’s narrative and data can ensure that policyholders are fully informed when making decisions about cutting limits or self-insuring part of their insurance programs.

STRONG FOCUS ON VALUATION ADEQUACY

ITV remains a top nationwide concern as carriers emphasize a focus on underwriting discipline and profitability. That discipline is resulting in a move toward margin clauses of 110% – 120% and scheduled rather than blanket limits. Markets across the country are often requiring mandatory ITV and rate increases regardless of schedule size due to reinsurance requirements. Many accounts are seeing 30% – 40% increases in premiums due to rate and ITV adjustments. Property in coastal areas may see triple digit increases if a carrier pulls capacity from the program or if restructuring of limits is required. This typically has more of an impact on insureds who are new to the E&S market and aren’t used to these new restrictions versus those who saw substantial increases in 2021 and 2022 and have adjusted to this reality.

How Agents Can Help: Depending on the ITV, bifurcation may be a potential option, enabling some locations to be placed in the standard market and others in the E&S marketplace. It’s also helpful to be smart about considering the limits actually needed when it comes to quake or flood coverage.

DEDUCTIBLES ARE INCREASING

Deductibles are also increasing, previously ranging from $10K – $100K they’re now ranging from $50K – $250K. Higher deductibles are encouraging insureds to establish stronger risk management plans to mitigate their own loss exposure. Percentage deductibles for wind can also vary widely, from 1% in a place like Maine to 5% – 7.5% in the Southeast. Underwriters may seek to include a “per location” rather than “per building” deductible which can dramatically increase an insured’s retention. States like Tennessee and Georgia, not commonly hail or wind-focused, are also now seeing 1% -2% hail or wind deductibles in contrast with deductibles of 10% – 15% for named windstorm in Florida or Texas.

Hail deductibles have become common in Texas and Oklahoma and are sitting between 1% – 5%. Percentage deductibles are also making a debut in other states like Wisconsin, Indiana, and Minnesota, making it important that agents and brokers be creative and consider offering deductible buy downs on wind and hail exposures. In the Central U.S. if a roof is more than 10 – 18 years old, underwriters will likely seek to incorporate the Actual Cash Value (ACV) basis roof endorsement.

How Agents Can Help: In some instances, it may make sense to shift to a short primary in order to access the more robust buffer markets or price the master program with higher deductibles followed by seeking a deductible buy down. A knowledgeable wholesale broker can help push back against “per location” deductibles and navigate the deductible buydown options available.

MARKETS EXITING AFTER CONTINUED LOSSES

Across the country, several large, admitted carriers have exited the space, resulting in significant disruption. Insureds that have previously relied on package policies are entering the E&S market, obtaining monoline coverage, and facing premiums that are four or five times higher than expiring. Carriers are also getting some lift on premium by taking valuations up by 20% – 30% or even more in some instances. Those insureds refusing higher valuations will likely see higher All Other Perils (AOP) deductibles, possibly a coinsurance requirement, or ACV-based endorsements due to concerns over construction costs.

How Agents Can Help: Based on current market conditions and the extensive layering required, it’s wise to have submissions complete by 90-120 days out. This is especially important when considering how few markets remain and how long the underwriting process can take. The markets that remain in the space are flooded with submissions which adds to the typical turn-around time.

TOUGH VENUES & SECTORS

Certain regions throughout the country generally have a greater likelihood of increased claim frequency and more severe losses due to massive jury verdicts. This is occurring in some locations more than others, and examples of tough venues include California, New York, Florida, Texas, Louisiana, Mississippi, and Georgia. Typically, in urban, more litigious areas such as Chicago, Philadelphia, and New York City, prices remain high.

How Agents Can Help: Every habitational property account needs a strong renewal plan. A thorough and complete submission is the single most important item retail agents and brokers can provide. While 5 years of loss history has been the norm in the industry, many markets now seek 8-10 years of currently valued loss runs.

BOTTOM LINE

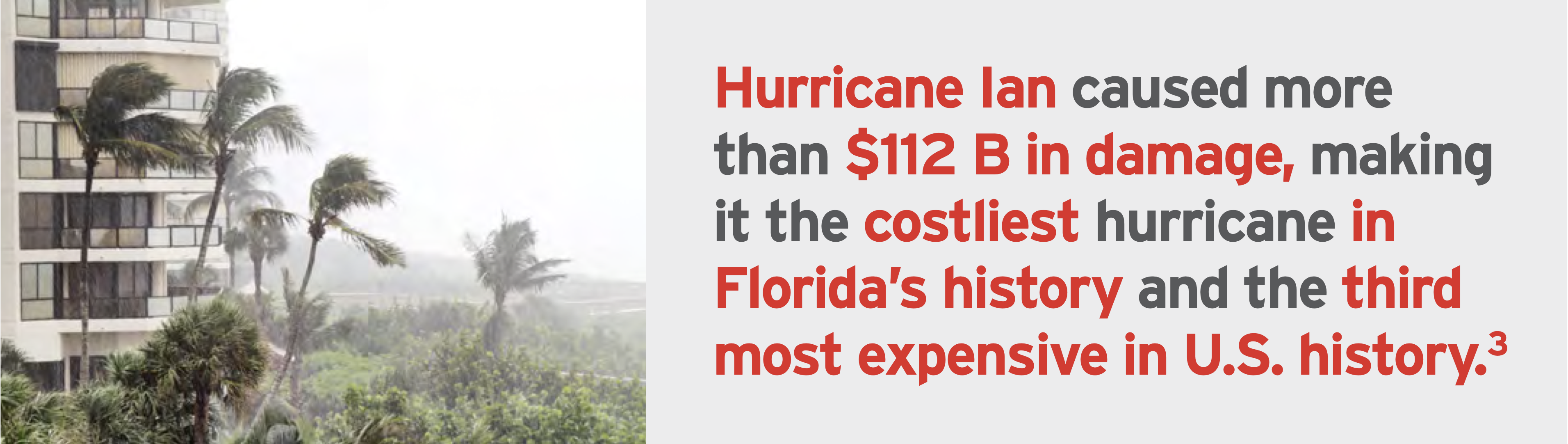

Creativity is the name of the game. With the right strategy and planning a solution can be found. It can be easy for insureds to assume that these marketplace conditions are something being done to them by insurance companies. But the reality is – claims aren’t going away, and insurers have to underwrite to a profit. Carriers are constantly monitoring claim activity and loss development year over year – making it a moving target as to what premium should be based on how those losses develop. In addition, underwriters are considering the potential impact of the new North Atlantic hurricane model from RMS, which indicates increases in expected losses in Texas, the Gulf Coast, Florida, and the Southeast of up to 30%. The update is likely to factor into modeled output to drive Probable Maximum Loss (PML) and deployment of aggregate into 2024.4

As carriers reduce limits or employ exclusions, it’s vital that clients and their insurance providers collaborate to fully understand and adequately communicate the exposures of each account. Underwriters are consistently requesting more and better data to accurately assess and price habitational risks. Solid risk management plans showcasing the strengths of habitational policyholders can increase underwriters’ level of comfort with a risk and make a difference in the scope of obtainable coverage.

Successfully navigating the current hard market conditions also means proactively marketing risks with sound brokering and follow-up. CRC Group leverages the power of institutional-level proprietary data, exclusive products, and internal relationships to help ensure clients benefit from the best possible deal, every time. Contact your local CRC Group producer today to learn more about how we can help your habitational clients weather the continuing hard market with unique insurance solutions.

CONTRIBUTORS

Daniel Ball is a Property Broker with CRC Group’s Boca Raton, FL office.

Matt Kreis is a Senior Vice President & Property Broker with CRC Group’s Norcross, GA office.

Stacey Newman is an SVP & Property Broker with CRC Group’s Chicago, IL office.

David Pagoumian is the president of CRC’s Red Bank, New Jersey office and a member of the Property Practice Advisory Group.

Kevin Ronan is a Property Broker with CRC Group’s Irvine, CA office.

Mark Sangenito is a Senior Vice President and Property Broker with CRC Group’s Dallas, TX (Walnut Hill) office.

- Habitational Market Ripe for Digital Transformation, Insurance Journal, August 16, 2021.https://www.insurancejournal.com/magazines/mag-features/2021/08/16/627099.htm

- Higher Material Prices Here to Stay, Construction Dive, June 1, 2023.https://www.constructiondive.com/news/falling-material-prices-expected-reverse-course/651744/

- NATIONAL HURRICANE CENTER TROPICAL CYCLONE REPORT, NOAA, April 2, 2023.https://www.nhc.noaa.gov/data/tcr/AL092022_Ian.pdf

- RMS 23 Hurricane Model Update Could Compound CAT Supply Constraints, E&S Insurer, June 30, 2023.https://www.es-insurer.com/news/rms-23-hurricane-model-update-could-compound-cat-supply-constraints/

- Top Strategies for Navigating the Habitational Market, The Rough Notes Co., February 2023.https://roughnotes.com/habitational-market-2/